Best Professional Tax Preparation Software

Tax preparation companies take all the work out of taxes. Tax software lets you do your taxes without the help of a professional. It also lets you complete most of the paperwork and then speak to. The best tax preparation software for tax professionals. Our tax software for tax professionals comparison chart shows detailed information that professional preparers need. Mame32 windows 10. It is important to note that the editor has solely focused on features, technology, and useful integrations as benchmarks for ratings.

Accuracy

The most important feature of any tax software program is accuracy. An inaccurate tax return could cost a taxpayer hundreds or even thousands of dollars. Both errors in favor of the taxpayer and in favor of the IRS can be costly.

- Error check: Most tax software programs run an error check prior to filing the tax return.

- Accuracy guarantee: Companies typically offer an accuracy guarantee, which ensures that the calculations the program completes are accurate. The guarantee doesn’t cover human mistakes, though, so it is important that taxpayers verify all of the data entered into the system.

- Professional review: Some programs allow taxpayers to pay an additional fee to have their return reviewed by a tax professional.

Ease of use

No matter how accurate and well priced a tax software program is, if it isn't easy-to-use then customers will take their business elsewhere. Tax time is stressful for many taxpayers, and the last thing anyone wants is the challenges of a difficult to use program.

- Online programs: Web-based software programs eliminate the need for a local software installation, which reduces compatibility problems.

- Interviews: The most popular tax software programs use an interview approach to gather tax data; this makes tax preparation a simple and hassle-free process.

- Table of contents: In addition to the interview approach, many of the more popular programs allow taxpayers to pick and choose specific forms. This is a great feature for more experienced users.

Data security

Data security is of the utmost importance. Hackers, unscrupulous employees, fires and floods are just a few of the ways that your data could be compromised or lost.

- Data security software: A completed tax return has everything an identity thief needs to set up financial accounts in your name. Tax software companies need to utilize the latest in security software and post a security policy online.

- Account disclosures: Tax software companies should disclose what happens to your credit card or bank account information when your return is complete. Is the data stored for future use or removed from the system?

- Disaster recovery plan: Companies should also have an adequate disaster recovery plan in place because a fire or natural disaster could destroy your data. Taxpayers that failed to make a personal backup won’t have access to important financial records.

Help and support

Tax software, at its core, is a do-it-yourself project. There is a reason that taxpayers, by the millions, opt for software programs over an accountant – they like the DIY aspect. However, people do run into problems, so a solid help and support system is an integral part of any tax software package.

- Live chat support: Companies can provide longer support hours by utilizing a live chat support service.

- Phone support: Even web-based programs need to have a phone support option because there are some problems that can’t be solved efficiently using text-based interactions.

- Knowledge base: Most DIY taxpayers would rather research their problems than wait for a customer service response, which makes a comprehensive knowledge base a valuable resource.

Tax refund options

Gone are the days of waiting months for a check from the IRS to arrive in your mailbox. While taxpayers can still opt to receive a paper check, the IRS and most tax software programs offer direct deposit and other refund options like U.S. Savings Bonds, prepaid debit cards and more.

- Direct deposit: All of the major tax software providers offer customers a direct deposit option.

- Paper checks: The IRS and software companies still offer paper checks to taxpayers expecting a refund.

- Prepaid debit cards: A prepaid debit card loaded with the refund is a great option for taxpayers without a bank account.

Filing options

A tax software program that offers multiple filing options is preferred. While online filing is a popular choice, not every taxpayer has access to the Internet or wants to submit sensitive data electronically. A program that offers both online and print and mail options leaves this decision up to the customer.

- Online: All of the popular tax software programs allow online tax filing, in addition to tax preparation services.

- Print and mail: Some programs allow taxpayers to print and mail a copy of their returns.

- Online and print: The best option is to file your return electronically and then print a copy for personal records.

When you file taxes, you must declare two types of taxable income: earned income and unearned income.

Earned income is what most people usually think of when it comes to filing taxes because it’s income that results from employment. It includes:

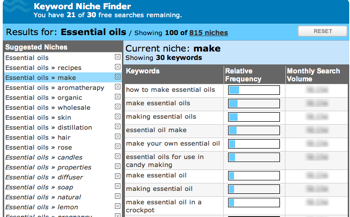

Comparison Of Professional Tax Software

Salary and wages

Bonuses

Tips

Commissions

Sick pay

Unemployment benefits

For most individuals who are paid a salary or wage, the amount of money you earn before taxes are deducted is known as your gross income. When you’re paid by your employer, some percentage of your salary is automatically taken out for taxes depending on your filing status. The amount of money that you actually take home each week is known as your net income.

If you’re self-employed or work as independent contractor, taxes typically aren’t taken out of your weekly pay. As a result, you may pay estimated taxes each quarter to ensure that you won’t owe too much at the end of the year.

Unearned income is income that’s generated from sources other than employment. It includes:

Rent

Interest

Dividends

Business and farm income

Profit from asset sale

Royalties

Gambling winnings

Alimony

Affordable Tax Software For Professionals

Taxes are usually not automatically deducted from these types of income.